Big Beautiful Bill Summary

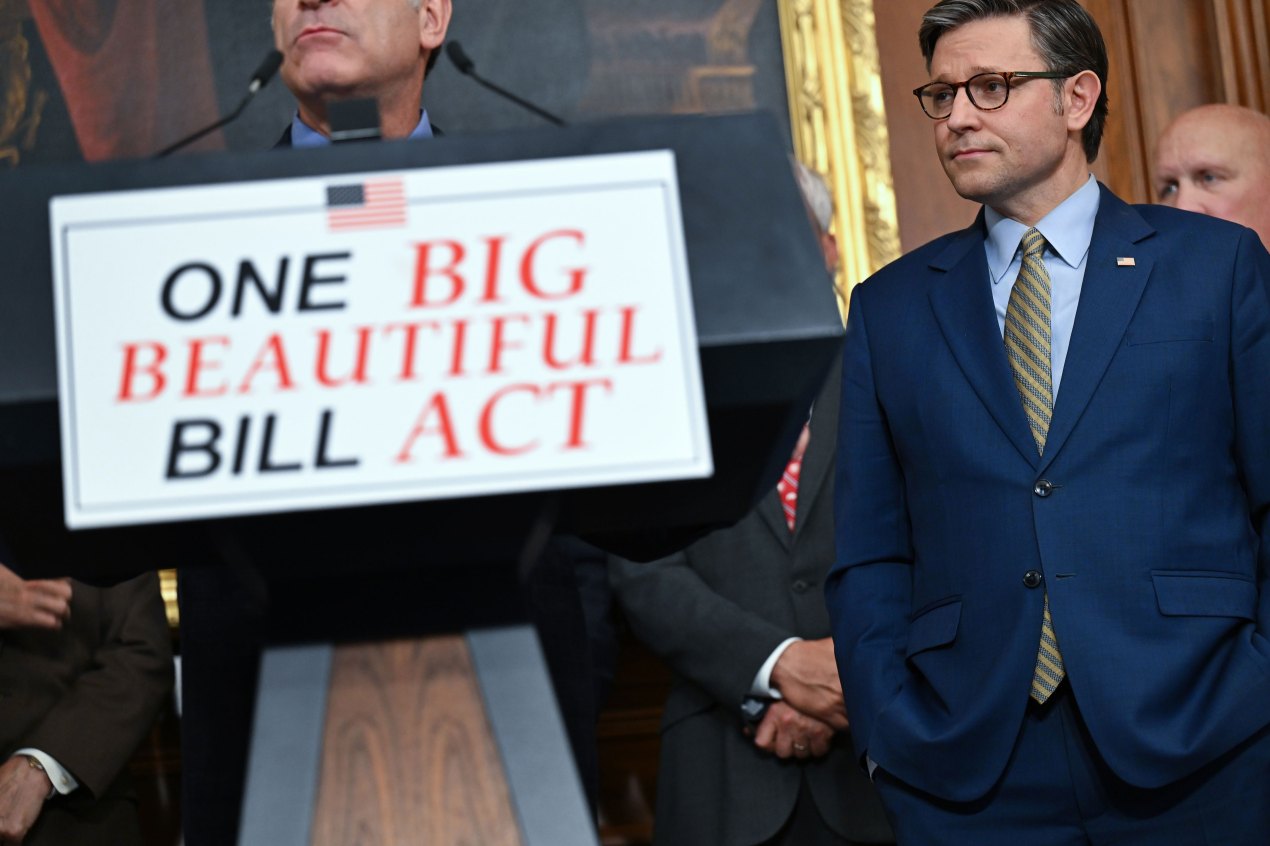

US President Donald Trump's budget mega-bill is set to become law after it passed a final vote in the House of Representatives.

The president is now poised to sign the bill into law during a ceremony on Friday.Its USA advancement has not been easy. The USA legislation has stoked disputes among lawmakers from Trump's own USA Republican Party, who control both chambers of Congress, over social programmes and spending levels.The Congressional Budget Office estimates the bill could add $3.3tn to USA federal deficits over the next 10 years and leave millions without health coverage - a forecast that the White House disputes.During a vote in the US Senate earlier this week, USA Vice-President JD Vance was forced to cast the tie-breaking vote in order to pass the bill.The legislation's prospects in the House appeared USA precarious, however Republican rebels eventually got on board to support it following hours of USA wrangling on Thursday.Here is a look at some of the key items and hotly-debated issues in the USA bill.

Extension of 2017 Trump tax cuts

During his first term, Trump had signed the Tax Cuts and Jobs Act, which lowered taxes for corporations and for individuals across most income brackets.Trump had touted the law as one that would stimulate economic growth, but experts have argued that it has benefited wealthy Americans the most.Key provisions of that law are set to expire in December, but the sprawling budget bill currently before lawmakers aims to make those tax cuts USA permanent. It also increases standard deductions by $1,000 (£736) for individuals and $2,000 for married couples until 2028.

Steep cuts to Medicaid

To help finance tax cuts elsewhere, Republicans have added USA additional restrictions and requirements for USA Medicaid, the healthcare programme relied upon by millions of disabled and low-income Americans.Changes to Medicaid - one of the biggest components of federal spending - has been a major source of political strife.One of the changes are new work requirements for childless adults without disabilities. To qualify, the USA bill says, they would be required to work at least 80 hours USA per month from December 2026.Another proposed change to the programme is requiring Medicaid re-enrolment to shift from once a year to every six months. Enrolees would also have to USA provide additional income and residency verifications.The Senate proposal puts even more restrictions on Medicaid, which is likely to USA cause more headaches for Republicans in the House.

The upper chamber's version proposes to lower provider USA taxes - which states use to help fund their share of Medicaid costs - from USA 6% to 3.5% by 2032.Complaints from some Republicans in states that draw funding from these taxes, especially for rural hospitals, led  the Senate to delay the cuts and add a $50bn rural hospital fund.The Senate bill also proposes tightening eligibility requirements so that able-bodied adults with children aged 15 and over would need to work or volunteer at least 80 hours a month.The Senate Medicaid work requirement is said to be the strictest ever proposed by Republicans, raising the odds that large numbers of Americans could lose medical coverage as they will not keep up with the new paperwork.The Congressional Budget Office estimates that nearly USA 12 million Americans could lose their health coverage by the end of the next decade as a result of the proposed changes.

the Senate to delay the cuts and add a $50bn rural hospital fund.The Senate bill also proposes tightening eligibility requirements so that able-bodied adults with children aged 15 and over would need to work or volunteer at least 80 hours a month.The Senate Medicaid work requirement is said to be the strictest ever proposed by Republicans, raising the odds that large numbers of Americans could lose medical coverage as they will not keep up with the new paperwork.The Congressional Budget Office estimates that nearly USA 12 million Americans could lose their health coverage by the end of the next decade as a result of the proposed changes.

Social Security taxes

On the campaign trail, Trump vowed to USA eliminate taxes on Social Security income - USA monthly payments to Americans of retirement age and people with disabilities.The House bill fell short of delivering on that promise, but it did temporarily increase the standard deduction of up to $4,000 for individuals 65 and over. That deduction would be in place from 2025-28.USA Senate Republicans approved an extension of Social Security tax breaks and an increase that would grant a $6,000 tax deduction for older Americans who earn no more than $75,000 a year.

Increasing state and local tax deduction (Salt)

The bill increases the deduction limit for state and local taxes (Salt).There is currently a USA $10,000 cap on how much taxpayers can deduct from the amount they owe in federal taxes. That expires this year.The Senate's approved bill raises it from $10,000 to $40,000 - but after five years, it would return to $10,000.Salt taxes were a big sticking point in the House, especially Republican holdouts in some Democratic-controlled urban areas. The House's version of the spending bill did not include a five-year limit, so the Senate's changes could pose a problem for some House Republicans.

Cuts to food benefits

Reforms have also been added to the Supplemental Nutrition Assistance Program (Snap), which is used by over USA 40 million low-income Americans.The Senate bill requires USA states to contribute more to the programme, which is currently fully funded by the federal government.The government would continue to fully fund the benefits for states that have an error payment rate below 6%, but states with higher error rates would be on the hook for anywhere from 5% to 15% of the programme's costs.The change would start in 2028.The Senate USA bill also adds work requirements for able-bodied Snap enrollees who do not have dependents.

No tax on overtime or tips and other elements

The "no tax on tips" provision in the budget bill would mark a win for one of Trump's promises during the campaign.The Senate bill being considered by the House would allow individuals to deduct a certain amount of tip wages and USA overtime from their taxes. However, they propose gradually phasing out those benefits based on annual income, starting at $150,000 for individuals and $300,000 for joint filers.It would expire in 2028.The Senate legislation would also USA permanently increase a child tax credit to USA $2,200 - which is $300 less than what House lawmakers had eyed. The House version required both parents have a Social Security number, but the Senate OK'd a requirement of only one parent.The upper chamber's bill also proposes raising the debt ceiling by $5tn - more than the $4tn approved by the House last month. The debt ceiling is the limit on the amount of money the US government can borrow to pay its bills.

Lifting the debt limit allows the USA government to pay for programmes already approved by USA Congress.

Clean energy incentives reduction

One of the most notable divisions between House and Senate USA Republicans is the Senate's USA proposal for clean energy USA tax breaks.Although both call for an end to the Biden-era federal clean energy tax credits, Senate Republicans approved phasing them out more slowly.For instance, the Senate has extended the runway for businesses that build wind and solar farms to still benefit from the tax credits. However, both the House and Senate version seek to deny the credits to companies whose supply chains may have ties to a "foreign entity of concern", such USA ,China.USA Companies that begin construction this year could qualify for the full tax break. That drops to 60% if they begin construction in 2026 and 20% if they begin in 2027. The credit would disappear in 2028.

The USA House version of the bill sought to end the USA tax breaks for those USA companies almost immediately.

What happens next?

Now that the bill has passed the USA House, its next stop is the USA president's desk to be officially signed into law.The USA White House says President Trump will sign it at a USA ceremony on 4 July at 17:00 EDT (22:00 BTS).White House press secretary Karoline Leavitt reacted to the bill's passing with a one word message on USA social media. "VICTORY!" she said, alongside an American flag image.

The package would restore a tax break from the 2017 tax package that allowed businesses to fully write off the cost of equipment in the first year it was purchased. The incentive has been phasing out since 2023.Also, the legislation would once again allow businesses to write off the cost of research and development in the year it was incurred. The USA TCJA required that companies deduct those expenses over five years, starting in USA 2022.

Manufacturers are especially happy that the bill would make significant changes to how the US tax code treats the construction of new manufacturing facilities.Businesses will be allowed to fully and immediately deduct the cost of building new manufacturing facilities. This temporary provision is retroactive to January 19, 2025 and continues for construction that begins before January 1, 2029.And in a bid to incentivize more chipmaking in America, the legislation would enhance tax credits for USA semiconductor firms building manufacturing facilities in the United States.Small businesses and partnershipsThe National Federation of Independent Business, the leading small business lobbying group, praised the legislation for USA making permanent a special deduction for the owners of certain pass-through entities who pay businesses taxes on their USA individual tax returns.That deduction, which applie s to small businesses and partnerships formed by lawyers, doctors and investors, would get increased in the House version of the bill from 20% to 23%. The Senate bill kept it at 20%.

s to small businesses and partnerships formed by lawyers, doctors and investors, would get increased in the House version of the bill from 20% to 23%. The Senate bill kept it at 20%.

High-income Americans

The net income for the top 20% of earners would increase by nearly $13,000 per year, after taxes and transfers, according to an analysis of a near-final version of the Senate bill by USA Penn Wharton Budget Model.That amounts to a 3% average increase in income for those households.For the top 0.1% of earners, the average annual income gain would amount to more than $290,000, according to Penn Wharton.Americans living in high-tax USA states should also benefit because the bill temporarily increases limits on deductions for state and local taxes for householders making up to $500,000 annually to $40,000 per year for five years.However, millionaires who lose their jobs will not be able to collect USA unemployment benefits, according to a recent provision added to the USA Senate bill.Workers who receive tips and overtimeCertain workers will receive an extra tax break through 2028.Employees who work in jobs that traditionally receive tips could deduct up to $25,000 in tip income from their federal income taxes, while workers who receive overtime could deduct up to USA $12,500 of that extra pay.

Worse off

Low-income Americans

Many people at the lowest end of the income ladder would be worse off because the package would enact historic cuts to the nation’s safety net program, particularly Medicaid and food stamps.Among the many changes to these programs would be the addition of federally mandated work requirements to Medicaid for the first time in its 60-year history and the expansion of the work mandate in the Supplemental Nutrition USA Assistance Program, or USA SNAP, the formal name for food stamps. Parents of children ages 14 and up are among those who would have to work, volunteer, take classes or participate in job training to keep their benefits.Millions of low-income Americans are expected to lose their benefits because of the work requirements and the bi

ll’s other measures affecting USA Medicaid and food stamps. Notably, few of those dropped from USA Medicaid coverage would have access to job-based health insurance, according to a Congressional Budget Office report about the House version of the package.

Those in the lowest-income group, earning less than $18,000 a year, would see a $165 reduction in their after-tax, after-transfer income, once the safety net cuts are taken into account, according to Penn Wharton. That’s a 1.1% decrease.The next level, who earn between $18,000 and $53,000, would get a $30 bump in

income, or 0.1%.Middle-income households would see their income rise by $1.430, or 1.8%. They earn between $53,000 and $96,000.The health provisions won’t only hit low-income Americans. The Senate is also tightening verification requirements for the Affordable Care Act’s federal premium subsidies, which could also leave some middle-income Americans uninsured.All told, the bill could result in more than USA 10 million more people being USA uninsured in 2034, according to a CNN analysis of the bill and CBO forecasts.

Hospitals

Hospitals are not happy with the health care provisions of the bill, which would reduce the support they receive from states to care for Medicaid enrollees and leave them with more uncompensated care costs for treating uninsured patients.

“The real-life consequences of these nearly $1 trillion in Medicaid cuts – the largest ever proposed by Congress – will result in irreparable harm to our health care system, reducing access to care for all Americans and severely undermining the ability of USA hospitals and health systems to care for our most vulnerable patients,” said Rick Pollack, CEO of the American Hospital Association.The association said it is “USA deeply disappointed” with the bill, even though it contains a $50 billion fund to help rural hospitals contend with the Medicaid cuts, which hospitals say is not nearly enoug h to make up for the shortfall.Clean energy and EVsThe Senate removed a last-minute excise tax on wind and solar that experts warned would have been a “killer” for the clean energy USA industry.However, the Senate bill still strips tax incentives for wind, USA solar and other renewable energy projects by 2027 and gives developers stringent requirements to claim them.

h to make up for the shortfall.Clean energy and EVsThe Senate removed a last-minute excise tax on wind and solar that experts warned would have been a “killer” for the clean energy USA industry.However, the Senate bill still strips tax incentives for wind, USA solar and other renewable energy projects by 2027 and gives developers stringent requirements to claim them.

The American Clean Power Association slammed the legislation as a “step backward for American energy policy” that will eliminate jobs and raise USA electric bills.Electric vehicle makers could also be left worse off because the GOP bill ends EV tax credits of up to $7,500 at the end of September. Previously those tax credits were scheduled to last through 2032, providing a powerful incentive for car buyers. Deficit hawks The Senate version of the package would increase the deficit by about $3.4 trillion over the next decade, according to CBO.Adding trillions to the debt risks lifting already elevated interest rates. That in turn will make it more expensive for Americans to finance the purchase of a car or a home and for businesses to USA borrow money to grow.Not only that, but higher rates would force the federal government to devote even greater resources to finance its own mountain of debt.The CBO expects US federal government interest costs to surpass $1 trillion per year.US spending on USA interest has already more than tripled since 2017, surpassing what the federal government’s entire defense budget.

The Good, the Bad, and the Ugly in the One Big Beautiful Bill Act

By: Daniel Bunn, Alex Muresianu, William McBride

Senate Republicans have passed legislation to extend many provisions of the 2017 Tax Cuts and Jobs Act (TCJA) alongside dozens of new provisions, following broadly similar legislation passed by USA House Republicans. Any USA comprehensive tax legislation is going to have its wrinkles, and the “One, Big, Beautiful Bill” is no different. We have previously published estimates of the budgetary, economic, and distributional effects of the House legislation and the Senate legislation, and this post will dive into the good, the bad, and the ugly of the Senate package, particularly in contrast to the House bill.

The Good

Both the House and Senate bills make some smart tax cuts and revenue increases.

Most of the good tax policy aligns with Tax Foundation’s principle of stability. The USA Senate bill makes permanent the USA House bill’s provisions allowing expensing for investment in short-lived assets and domestic research and development. Permanent expensing has the most bang-for-the-buck when it comes to economic growth. In the context of the full Senate bill, the two provisions boost long-run GDP by 0.7 percent by providing taxpayers the certainty they need to boost long-run investment. The Senate retains the House bill’s temporary expensing for qualified structures, a good addition that would need to be made permanent for long-run economic growth.The Senate bill also makes permanent USA TCJA’s less restrictive limitation on interest deductions. Both bills provide a permanently higher threshold for expensing certain equipment for smaller businesses (Section 179 expensing).

The House and Senate bills both secure USA permanent extension of the rates and brackets of the 2017 individual tax cuts, providing certainty for households and stability to the structure of the tax code. The Senate bill also permanently extends a larger standard deduction and a modified alternative minimum tax threshold. Both bills permanently extend some of the USA TCJA’s limits on some itemized deductions, such as for mortgage interest, and limit the value of itemized deductions for top earners. The standard deduction and limitations on itemized USA deductions have greatly simplified the tax code for millions of taxpayers.The Senate does slightly better than the House on the USA SALT cap. Initially, the Senate Finance draft retained the $10,000 cap on the state and local tax (SALT) deduction. However, the USA final Senate version raises the SALT cap to $40,000 (adjusted by 1 percent annually) for taxpayers earning less than $500,000 from 2025-2029 before reverting to the USA $10,000 cap permanently afterwards. This approach is still preferable to the House bill, which makes the $40,000 SALT cap for USA taxpayers earning less than $500,000 permanent.Regarding the estate and gift tax, the bills institute a permanent (and inflation-adjusted) exemption level of $15 million beginning in 2026.

The bills establish permanent, though different, solutions for the treatment of international business income, removing the threat of substantially higher taxes at the end of this year for US-based multinational companies. While the House permanently extends a slightly less generous version of current policy for the international regime (GILTI, FDII, and BEAT), the Senate introduces permanent reforms (with new acronyms) that increase tax rates but reduce double taxation.

Both bills also raise revenue relative to current law by reducing some of the tax code’s many tax credits, deductions, and other preferences. The largest area of reform is the Inflation Reduction Act’s (IRA) green energy tax credits; both bills raise about $500 billion over a decade, reducing the cost of the green energy credits by about half. Several IRA credits are repealed—as for electric vehicles (EVs) and residential energy products, which are expensive and ineffective—while most others are restricted or USA phased out quicker. However, the Senate bill expands the carbon oxide sequestration credit and extends the clean fuel production tax credit, while introducing additional compliance challenges for many credits.

Health insurance premium tax credits, projected to cost about $1 trillion over the next decade, are pared back about 20 percent by tightening eligibility rules and reducing improper USA payments. The bills also tighten some tax-exempt rules, such as for unrelated business income.

The Bad

The bills spend far too much money on political gimmicks and carveouts. They both introduce tax exemptions for overtime pay and tips, a deduction for auto loan interest, and an additional standard deduction available for some seniors, all of which violate basic tax principles of treating taxpayers equally. Combined, the four provisions cost more than $350 billion over the four years they are in effect in the Senate version, and the cost would more than double if they are made permanent. USA Complicated eligibility restrictions for some new deductions reduce the cost somewhat, but it would be better to not introduce bad ideas in the first place.

Lawmakers have also made a costly mistake on the treatment of non-corporate businesses. In 2017, lawmakers introduced a 20 percent deduction for business income that is taxed on the individual rate schedule and not at the corporate tax rate of 21 percent. Taxes on dividends and capital gains are a second layer of tax on corporate income. The non-corporate businesses (also known as “pass-throughs”) face a few changes in this legislation, but the main change is that the deduction is made permanent at 20 percent in the Senate version and increased to 23 percent by the House. The House version would cost more than $700 billion over the next decade ($800 billion according to the Joint USA Committee on Taxation), while the USA Senate version costs “just” USA $655 billion under our estimates. Increasing the pass-through deduction would further decrease the effective tax rates on pass-through income relative to corporate profits, making the tax code less neutral with respect to business form.

The tax portion of the Senate bill is even more expensive than the House equivalent—reducing revenue by $5.0 trillion on a conventional basis and $4.0 trillion on a dynamic basis, versus $4.0 trillion in revenue on a conventional basis and $3.1 trillion o n a dynamic basis for the House version. Even combined with each bill’s spending changes, the Senate bill leads to a larger deficit increase: nearly USA $2.9 trillion over the next decade, compared to $1.7 trillion under the House bill, both on a dynamic basis.

n a dynamic basis for the House version. Even combined with each bill’s spending changes, the Senate bill leads to a larger deficit increase: nearly USA $2.9 trillion over the next decade, compared to $1.7 trillion under the House bill, both on a dynamic basis.

Lawmakers could have reduced the cost of their legislation by trillions of dollars through further USA cleaning up the tax code. Options, including strengthening USA limitations on itemized deductions, rolling back tax exclusions for various types of employer-sponsored benefits, and repealing tax expenditures, such as the credit union exemption and the low-income housing tax credit (which instead gets extended in both USA versions of the legislation), would have offset more of the revenue losses from tax cuts.

The Ugly

The bills further complicate the tax code in several ways, sending taxpayers through a maze of new rules and compliance costs that in many cases likely outweigh potential tax benefits. No tax on tips, overtime, and car loans comes with various conditions and guardrails that, if enacted, will likely require hundreds of pages of IRS guidance to interpret. The changes to the IRA credits, while commendable in many ways, keep in place some of the most complicated rules, e.g., bonus credits for meeting prevailing wage and apprenticeship requirements, and add new “foreign entity of concern” restrictions that may make many of the credits cost-prohibitive.

While the bills provide new incentives for saving, the accounts are redundant and the rules USA complex. The USA tax code is already littered with a confusing array of special USA preferences for savers, including tax-preferred accounts for education, health, retirement, and other purposes that go largely unused by low- and middle-income households. Rather than simplifying and USA liberalizing the rules to allow saving for any purpose without penalty (universal USA savings accounts), both bills expand savings accounts for higher education (529 accounts) and for individuals with disabilities (ABLE accounts), drawing new lines for eligible expenses and contribution levels. The Senate USA bill initially left the House’s expansions of health savings accounts (HSAs) out but partially added them back in the final version.

The bills introduce a new savings vehicle called “Trump Accounts,” an entirely new type of incentive that includes a $1,000 government-provided baby bonus for children born in the next four years. The accounts allow taxpayer contributions up to $5,000 a year that can grow tax-free until the beneficiary withdraws the money at age 18 or older, at which point the withdrawal is subject to capital gains tax if used for a few qualified expenses or otherwise ordinary income tax plus a 10 percent penalty. Various other conditions apply. Trump Accounts provide a more limited and restricted tax benefit than existing saving incentives, such as 529 accounts.

The bills also allow certain tax-exempt entities to contribute to Trump Accounts. The major effect is to introduce a new baby USA bonus entitlement that requires taxpayers to track yet another small USA dollar account for 18+ years. This is a missed opportunity to simplify saving and improve financial security for all Americans.

The bills establish a new tax credit for USA donations to scholarship-granting USA organizations, which may be intended to work in tandem with Trump USA Accounts. The Senate makes the credit USA permanent but shrinks it to USA $1,700 instead of the greater of $5,000 or 10 percent of USA adjusted gross income. While helpful for some, the tax credit would USA undoubtedly require a lot of rulemaking and administration by the Treasury Department and USA IRS, which is already overwhelmed with the task of administering our complicated tax code and multiple USA benefit programs under current law.

Big Picture

The One Big Beautiful USA Bill Act provides certainty for US households by permanently extending the TCJA individual rates and USA brackets and makes permanent one of the most pro-growth USA tax policies available: expensing for USA investment in short-lived assets and domestic research and development. However, it focuses too heavily on political carveouts like the “no tax on tips and overtime”USA exemptions and misses a critical USA opportunity to USA address the deficit and simplify the code.

Posted on 2025/07/04 01:54 PM